by Christian Hudspeth, CFP®

Want to help yourself or someone in your family pursue higher education?

I can’t think of a better way to keep your legacy strong and your name remembered by those you love than by starting a college fund for them.

To do that, you’ll need a plan.

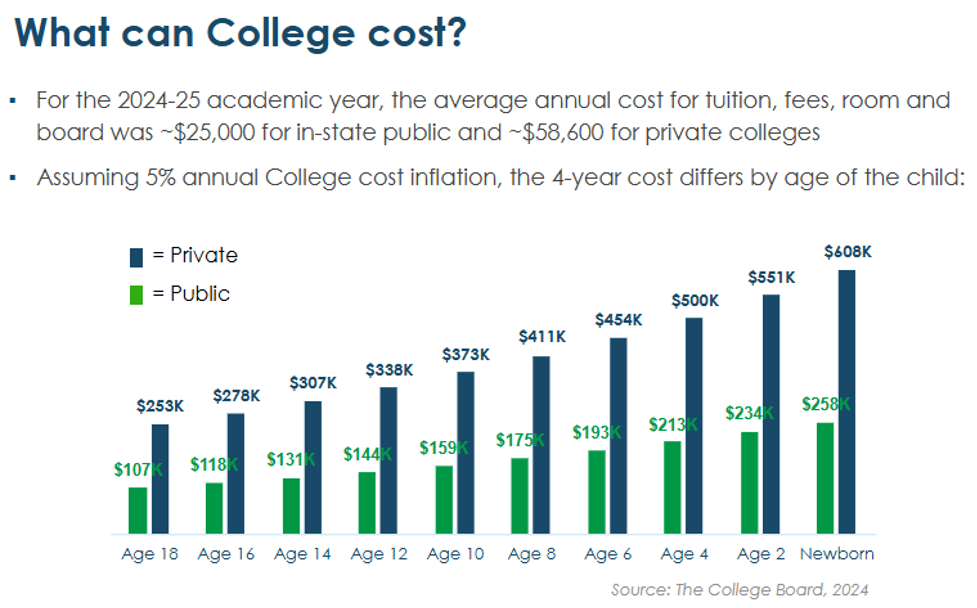

Here’s why. In the 2024-2025 academic school year, the cost to attend a public in-state college was around $25,000 per year while private colleges cost a whopping $58,600 per year according to The College Board. The chart below shows how much school could cost in future dollars depending on your loved one’s current age.

With tuition and room/board costs rising each year, today’s 18-year-old can expect to spend $107,000 total over four years when it’s time to attend an in-state public college. Today’s newborn can expect to spend $258,000 when it’s time for them to attend.

The good news is you CAN save enough to help pay for college. We help clients with it every day. You just need a plan to invest so you can help your family reach their education goals.

Today we’ll talk about the pros and cons of 529 plans, plus one alternative savings option you may not have considered to help someone you love (or even yourself) reach their education goals.

529 Plans

529 Plans are widely-used, tax-advantaged education accounts designed for saving toward college, graduate school, trade school and even some apprenticeship programs.

Typically, you (the grantor) fund these plans with after-tax dollars that are invested in target-date investment funds that fit the child’s (aka the beneficiary’s) time horizon until college. When it’s attendance time, you may take tax-free withdrawals from the 529 plan to use toward qualified expenses like tuition, fees, books, room and board, school supplies and laptops/computer equipment needed to complete studies.

529 Plan Pros:

Tax-advantaged growth. Flexible contribution rules mean a married couple may contribute a lump sum of up to $190,000 in 2025 alone (a single person can contribute $95,000 in 2025). Alternatively, you can contribute a smaller amount regularly over several years to fit the future education goal (tip: work with a financial advisor to avoid gift tax limit rules).

The invested dollars grow tax free for several years and can be withdrawn tax free when used toward qualified education expenses, potentially saving you thousands of dollars in taxes over time compared to saving in normal taxable accounts.

Financial aid friendly. For students who will be applying for FAFSA, 529 plans are considered assets of the parent (rather than the student), which is more favorable in the calculation for student aid.

Tip: If you’re a grandparent who is the grantor of a 529 plan, the assets are generally not required to be reported at all on FAFSA, greatly helping financial aid eligibility.

Great control. You choose how aggressively the funds are invested and when to distribute. And like with a trust (but without the complexities or cost of a trust), you can leave 529 plan assets to a beneficiary with the caveat that it’s used for education and not anything else, otherwise the beneficiary will have to pay taxes and penalties on non-education-related withdrawals.

The gift of a tax-free retirement. If your 529 plan beneficiary doesn’t end up using the funds for college, they may roll it over $35,000 of it into a Roth IRA over the course of several years for a future tax-free retirement. Read more about this relatively-new 529 perk in 5 Secure Act 2.0 Tax-Law Changes Ahead.

529 Plan Cons:

Lack of flexibility. If the beneficiary doesn’t end up using the 529 plan account for education, they may still withdraw funds for other uses but must pay income taxes plus a 10% penalty on the earnings (though the contributions may be withdrawn tax free).

If the beneficiary wants a K-12 private school education, the 529 plan lets you use up to $10,000 per year for that purpose. That said, many private schools cost far more than that, so other kinds of savings vehicles may be needed to afford pre-college private schooling.

Further reading: Non-Qualified Expenses: What You Can’t Pay for With a 529 Plan

Sometimes not worth the tax benefit. If the beneficiary is expected to use 529 plan funds for education within five years, the education account’s potential tax savings on growth could be minimal compared to a taxable account. Not only that, but funds inside a 529 plan are often invested in at least some stocks and bonds suited for longer time horizons, which introduces you to the risk of withdrawing funds during a down stock market and locking in investment losses.

Alternative: Taxable Brokerage or UGMA Accounts

If you’re a pre-retiree or retiree that’s already done your saving and you’ve worked with a financial planner to see if you have enough for your retirement needs, you may consider skipping the 529 plan and using funds from your taxable brokerage account to pay for your loved ones’ education. Or using a combination of the two accounts.

If you want the funds earmarked for the child, you could alternatively set up a separate taxable brokerage account for the future student as a custodial account — usually termed as a Uniform Gifts to Minors Act or UGMA account — for a minor child. You act as the owner (the custodian) and you can direct the spending until the minor reaches the age of majority (age 25 in Texas).

Brokerage / UGMA Pros:

Spending flexibility. Taxable brokerage money can freely be used for anything your child or grandchild may want without non-qualified withdrawal penalties.

Unlike a 529 plan, these funds could pay for:

- the student’s medical expenses,

- an emergency,

- a car to drive to school,

- or even a house to live in while attending college. Some of our clients like to rent out such a property after their child or grandchild moves out.

Investment flexibility. Unlike 529 plans which only allow you to choose from target-date-funds, taxable brokerage accounts allow you to invest in anything from individual stocks and bonds to commodities and alternative investments. And the annual growth rates on stocks and bonds are often several times higher than the 1% to 3% interest rates you could get from a bank account, helping you more effectively reach the beneficiary’s education goals.

Still some tax benefit. While these accounts don’t allow for tax-free withdrawals, they do still offer tax advantages over traditional bank savings accounts.

When it’s time to withdraw funds, the growth on the investment money is taxed at favorable capital gains tax rates (maximum of 23.8%) compared to bank account withdrawals which are taxed at ordinary income tax rates (maximum of 37% in 2025).

Brokerage / UGMA Cons:

Lack of control. UGMA accounts for minors only have age restrictions on withdrawals. As a taxable brokerage account, there are no stipulations for what the beneficiary can spend this money on.

Tip: If you’re using your own taxable brokerage account, you may consider funding the school or other expenses directly rather than giving it to the child first (this also avoids gift tax implications).

May be harder to manage on your own. While these accounts allow you to invest in anything, it also means you may have to watch investments closely to make sure you’re not exposed to unnecessary risks. Working with a financial advisor may be a wise choice to help you manage the funds and guide you as your loved one grows toward adulthood.

Takeway

529 plans offer excellent tax benefits and incentives to use funds for higher education, while custodial UGMA accounts may offer more spending flexibility.

Because there are so many moving parts toward planning for education, we recommend working with a trusted financial advisor. The right advisor should help you:

- First assess if you’re on track to retire (or stay retired)

- Discuss your goals and help you decide which education account suits your family,

- Calculate how much you need to contribute now to meet future education needs,

- Minimize your lifetime taxation by targeting future education expense deductions,

- And ensure you also have enough funds to pay for expenses a 529 plan won’t cover.

Whether you choose to plan this alone or want to work with our team, we wish you the best in setting up you or your loved ones for a quality education and successful future.

Further reading:

UGMA vs. UTMA vs. 529 Plans: Which Is Best for You? – Forbes Advisor

Prepaid Tuition Plans (Private College 529 Plan) – Collegewell

How Grandparents Can Help Grandchildren with College Costs – FMP Wealth Advisers

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.