By Christian Hudspeth, CFP®

As retirement draws nearer, some holding large positions in tech stock begin to get nervous. Especially with the great performance these stocks have had in recent years.

Take the performance of the “Magnificent 7” stocks – Microsoft, Amazon, Meta, Apple, Alphabet, Nvidia, or Tesla — over the past several years for example. Three of these Magnificent 7 stocks delivered a more than 900% return over 10 years (from September 2014 to September 2024) as reported by US News.

Nvidia grew an eye-popping 22,235% over the 10-year period.

Unsurprisingly, investors holding stocks with large unrealized gains can often feel tremendous anxiety. It’s not uncommon to have conversations with clients around:

“Should I sell my shares or keep them?”

“Do I need to diversify?”

“If I sell, what about capital gains taxes?”

While no answer will be perfect for everyone’s situation, today we’ll talk about some potential ideas to consider with the goal of diversification and minimizing taxes while also potentially reaching other financial goals.

Should I sell or hold my shares of a high-performing stock?

As a financial planner, I’ve seen first-hand how difficult it is for someone to let go of a stock that has doubled or tripled in value since they first bought shares.

This phenomenon is known as “recency bias” and it’s the tendency for people to rely heavily on recent trends or events. It is hard-wired into every one of us to help us avoid pain or the reduce the “fear of missing out.”

It can persuade you to avoid the beach after just hearing about several shark attacks. It can also convince you to hold onto an investment solely because of a string of positive annual returns.

But past performance does not guarantee future results.

Take Cisco Systems stock for example. If you had paid $2 per share for the talented tech company back in March 1995, you’d have rode that rocket ship over the next five years to a high of $77 per share for a stellar return of 3,750%.

At that point many Cisco investors were too scared to let go of such a gem. And they looked like geniuses at the time! But the dot-com burst put an end to that party, with Cisco’s stock plummeting a traumatic 80% in just one year. To this day (24 years later), the stock valuation has not recovered.

If you had a large portion of your portfolio money in that one stock, just imagine how many years that could have delayed your retirement. And it can happen easily to anyone working for a growing company that’s been awarding them stock shares over many years.

Should I Diversify?

Most of you have probably heard the adage “Don’t put all your eggs in one basket” if you want to reduce the risk of losing a lot of your eggs should that one basket fall.

The same is often true for investing. The closer you get to retirement, the more vital it is to diversify. That means exposing your portfolio to several different sectors, asset classes and global markets. It means setting up gains from some baskets so they may act as shock absorbers for losses in other baskets.

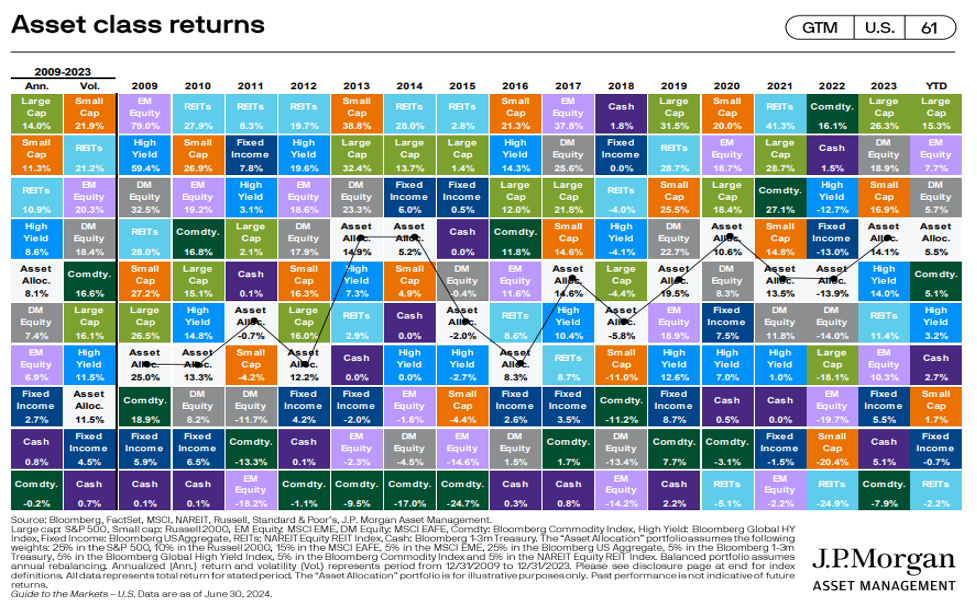

In fact, history shows a diversified portfolio not only reduces the risk of large losses compared to holding a less diversified portfolio, it also offers a narrower, more predictable range of returns.

Don’t take my word for it — look at the chart below from J.P. Morgan Asset Management which shows annual asset returns from 2009 through 2023. Note the diversified asset allocation shown in the white box.

Sure, a diversified portfolio may have less exciting returns in one year than one lucky stock pick.

But what you lose in the potential for oversized returns (and losses), you gain in respectable and reliable returns with diversification.

And when you’re counting on your portfolio to pay the bills in retirement, steady returns from a diversified portfolio are preferable to volatile and unpredictable returns!

Now I’m not saying you should sell your collection of tech or growth stocks. Holding 10% or even 30% of your portfolio dollars in a basket of high-quality stocks may be a strategy if you don’t need the money for a long time. It could even drive your overall portfolio’s growth if it supplements an otherwise diversified portfolio.

But holding 50% or more of your portfolio in one stock can be risky. And there are better ways to navigate to a successful retirement, depending on your situation.

Strategies to De-risk and Minimize Capital Gains Taxes

Depending on the size of your share position compared to the size of your overall portfolio and your unique goals, a trusted advisor with a financial planning team could help you:

- Sell a significant chunk of these largely appreciated shares, reducing your investment risk and creating an optimal risk-adjusted return for you, or

- Sell shares over many years to avoid pushing your income into higher tax brackets, thereby minimizing your lifetime taxes, or

- Keep your shares and build up positions in other asset classes to diversify and avoid triggering unnecessary capital gains taxes, or

- Donate your highly-appreciated shares to charitable causes to save you tax dollars this year and over your lifetime

The key with your strategy will depend on your personal situation. But it’s important to focus on the soundness of your investments first and “not let the tax tail wag the dog” here! In other words, your efforts to sell over time to keep out of higher tax brackets and save 5% per year on capital gains tax rates may prove fruitless if that high-flying stock you hold loses 5%, 10% or more during the year.

In the end, smart diversification, strategic investment planning, and forward-thinking tax planning will be your best friends. They are the keys to avoiding thousands of dollars in potential losses and position you for thousands of dollars in potential tax savings.

More from FMP Wealth Advisers:

- Are You Saving Too Much for Retirement?

- When to Keep Your life Insurance Policy (And When to Drop it)

- Pensions: Get Income for Life or Take the Lump Sum?

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.