by Christian Hudspeth, CFP®

When the stock market is having one-day drops of 2%, 3% or more, many investors instinctively want to follow the herd and run for the exits.

And that’s understandable. Sometimes it seems like a game of survival when it’s years or decades of your hard-earned dollars on the line at the whims at what seems to be a dangerous market. If that’s the way you’re feeling, I have an important message for you today.

Now, before I continue, if you’re currently retired, or a conservative investor with less than 10 years until retirement, this message is at least partly irrelevant to your situation and your unique investment strategy should encompass more than just money left in the stock market. That’s an article (or advisor meeting) for another day.

But for those of us who are still investing regularly for a retirement that’s at least 10 years away, history shows us it’s difficult to be successful in selling stocks and waiting until later “when things look like they’ve calmed down” before being invested again. In fact, timing the market incorrectly can put you years or even decades behind in reaching your retirement or other financial goals.

I have two charts that will show you exactly why.

Before we get to those, consider that seven of the 10 highest-returning market days (using the S&P 500 Index to represent the stock market) over the past 20 years happened within two weeks of the market’s largest one-day declines according to research by JP Morgan Asset Management.

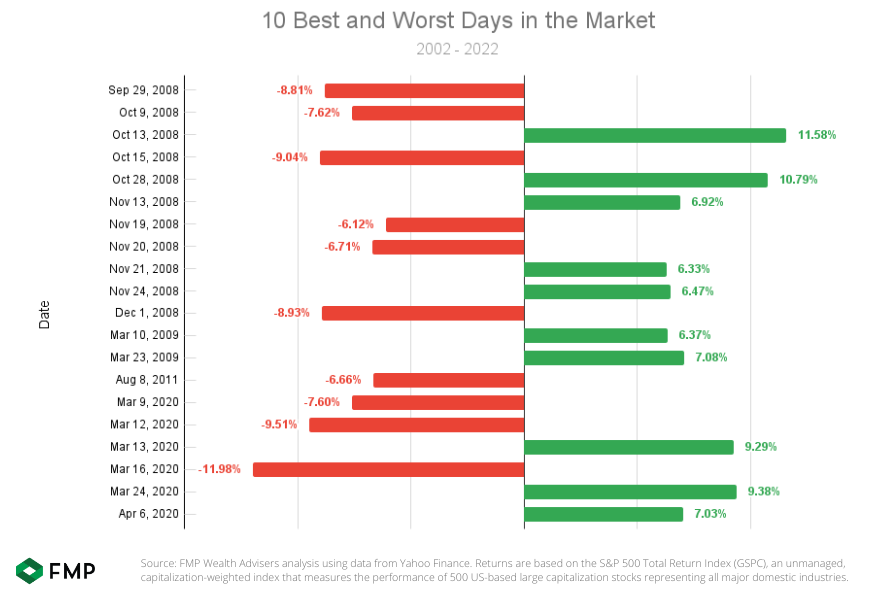

Aside from this year’s volatile market, the most vivid displays of roller-coaster days of the past two decades happened during a) the 2008 financial crisis and b) the first half of 2020 at the beginning of the Covid-19 pandemic.

First, let’s look at the 2008 financial crisis market downturn. The S&P 500 market index suffered a 38% decline from September 2008 and the end of March 2009. But it’s also important to know that seven out of 10 of the market’s best days over the past two decades also happened over that time.

You can see the market’s best up days in green and the market’s worst down days in red in the chart below:

Note the strongest market upswings happened soon after some of the largest one-day declines.

Let’s say on September 29, 2008, when the market fell 8%, you sold all of your stocks. While you would have avoided five heavy loss days, you would have also missed out on seven excellent market upswings with returns ranging from 6% to 11% per day over the following six months.

Now let’s look at the Covid-19-emergence market downturn in 2020 (shown in the last half of the chart above). Sure, the market had its two largest drops of the past 20 years during that downturn too, but the market also boasted three of the market’s 10 best days over the past two decades as well.

The cost of not being invested during the best days in the stock market

So maybe you’re thinking, “well so what if I took all my money out of the stock market and missed a few good days? A few good days can’t make much of a difference, can they?”

Well, it turns out the really good market days do make a difference. While the majority of market days over history are positive and feel “safe,” these usual days of small gains are not the days where the best stock investors make their fortunes.

In fact, for investors with more than a decade until retirement, history shows the difference between mediocre returns and great returns are when you stay invested during the best market days like the ones we just talked about.

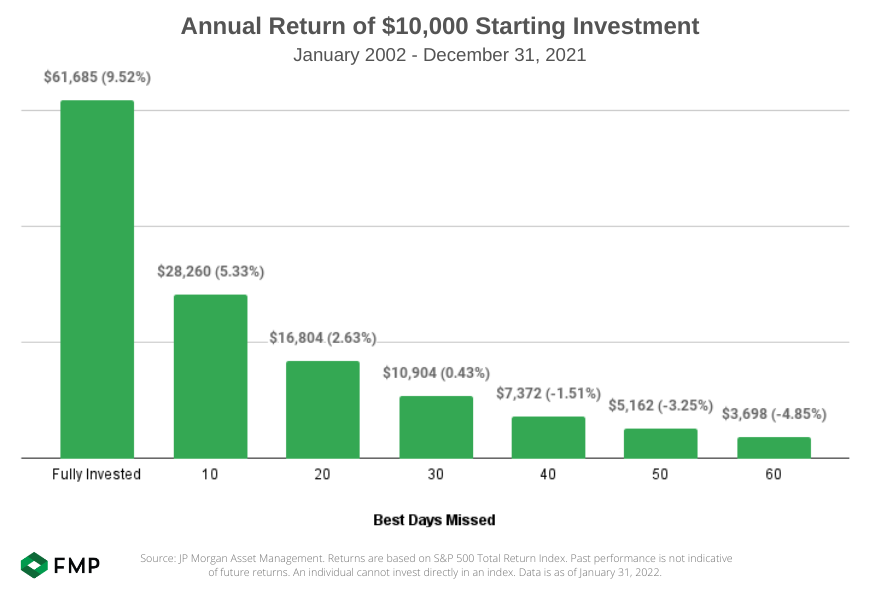

Consider this: according to the JP Morgan study mentioned earlier, someone who invested $10,000 in the S&P 500 index in January 2002 and left it to grow for 20 years would walk away with more than $60,000 by January 2022 for a 9.52% average annual return.

Now let’s look at another investor who had invested $10,000 on the same starting day but sold their stocks at the first sign of trouble. For example, they sold everything on September 29, 2008 as soon as there was a bad market day, and waited until March 25, 2009 to buy stocks again when the market got better. Then on March 9, 2020 they sold all of their stocks during the start of the Covid-19 downturn and bought all of their stocks again when the market was better after April 6, 2020.

Because the money of this “sideline investor” was out of stocks on the market’s 10 best days between January 2002 and January 2022, their investments would have grown to less than $30,000 for a 5.33% average annual return according to JP Morgan’s data.

In case you’re wondering, here’s what a $10,000 would have grown to over a 20-year period if you didn’t have your money invested in stocks on the highest-returning days of the stock market:

By missing just 10 of the market’s best days, the sidelines investor made a 5.33% return each year on average instead of a 9.52% return that a buy-and-hold investor made each year, for 20 years.

Let’s put this more into perspective. If the two investors each had invested $163,000 in the S&P 500 index back in January 2002, the buy-and-hold investor earning 9.52% annually would have a balance of more than $1,000,000 by January 2022. By comparison, the sidelines investor who earned 5.33% annually would have a balance of $460,500 over that period. The sidelines investor would have to wait an additional 15 years to reach $1 million assuming they continued to earn a consistent 5.33% annual return.

Would you have stomached holding onto your stock portfolio even through tough market days to reach a million dollars potentially 15 years sooner? I know my answer.

Now while no one can guarantee any stock return performance in the future, this historical market study shows the difference of being in or out of the stock market on the best days is like night and day. And in the past, history has shown the best days almost always happen after the worst ones.

Again, unless you’re close to retirement or otherwise really need access to your money immediately, most investors with a long time until retirement will find success not in “timing the market” but rather “time IN the market.”

This is not my phrase, but I love using it because it reminds us to keep our eyes fixed on the long term and not the sensational news of the day.

Stay brave friends. These choppy waters may continue but we hope this information is helpful if it aligns with your risk tolerance and financial goals.

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.