by Christian Hudspeth, CFP®

Here’s some good news — Congress’ passage of the Secure Act 2.0 on December 23, 2022 brings several legislative changes designed to let retirees keep their money growing tax-deferred for more years and help workers save more per year for retirement. The law builds upon its predecessor, the Setting Every Community Up for Retirement Enhancement Act of 2019 (Secure Act).

Whether you’re a retiree, an employee, a business owner, or all of the above, these changes are likely to impact your 401k and retirement plans over the next several years, particularly when it comes to contributions and withdrawal rules. There are also a few unexpected surprises in Secure Act 2.0 that allow more withdrawal flexibility from retirement accounts for emergencies and the ability to transfer money from unused 529 plans into Roth IRAs.

We have reviewed and summarized the legislation, and while this does not include every provision in Secure Act 2.0, we’d like to share some important highlights from the law with you.

For Retirees (or those soon-to-be)

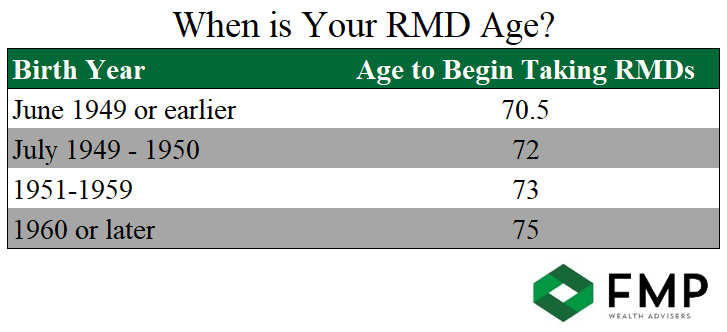

RMD age is raised again: The age when the IRS says you must begin taking required minimum distributions (RMDs) from your pre-tax retirement accounts (e.g. IRAs and 401ks) is increasing from age 72 to age 73 starting on January 1, 2023.

For example, if you turned age 72 in 2022, this change will not affect you and you’ll need to take your first RMD in 2022 or by April 2023. If you turn age 72 in 2023, you won’t need to take your first RMD until 2024 as that’s the age you turn 73.

Also per the law, the RMD age will again be raised to 75 beginning in 2033.

RMD penalty reduced: Effective in 2023, the 50% tax penalty for failing to take an RMD during the tax year is being reduced to 25% (and some circumstances as low as 10% if the taxpayer makes a timely correction).

RMDs for Roth 401ks are eliminated: Starting in 2024, retirees that live beyond their RMD age and have a Roth 401k may let it grow indefinitely without needing to take RMDs. This rule has existed for Roth IRAs even before Secure Act 2.0.

RMD “stretch rule” is back for certain beneficiaries: A surviving spouse may choose to delay taking RMDs from their deceased spouse’s IRA or employee retirement plan (e.g. 401ks or 403bs) until the year the deceased spouse would have turned their RMD age. This option is typically used if the deceased spouse was younger.

Beginning in 2024, if the surviving spouse elects to remain a beneficiary on the deceased spouse’s retirement account and then dies before the deceased-spouse’s RMDs were set to begin, the surviving spouse’s beneficiaries may be treated as the original beneficiary of the account. This allows beneficiaries to “stretch” distributions over their life expectancy rather than follow the 10-year withdrawal rule introduced by the original Secure Act.

For Workers Over Age 50

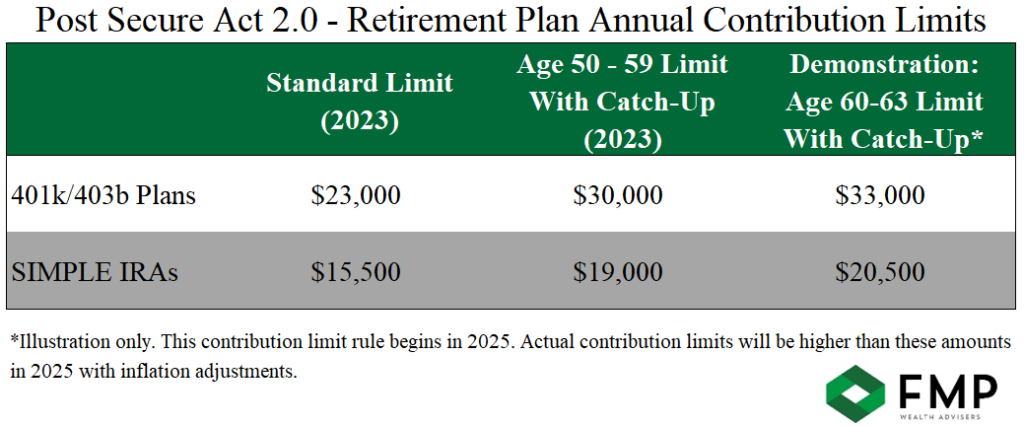

Enhanced Retirement “Catch-up” contributions for workers age 60 through 63: Beginning in 2025, workers age 60 through 63 with an employee retirement plan or a SIMPLE IRA may contribute an additional 50% over the existing annual catch-up contribution limits for those over age 50. For example, in a given tax year, a worker age 60 could make normal 401k contributions of $22,500, plus $7,500 in over-age-50 catch-up contributions, plus another $3,750 in age 60-63 catch-up contributions for a total annual 401k contribution of $33,750 (see table below). All catch-up contribution limits will grow each year with inflation.

Higher-wage earner catch-up contributions must be Roth: Effective 2024, workers age 50 and older that earned wages of more than $145,000 in the previous year will only be able to make after-tax Roth contributions for their catch-up contributions. An exception to this rule applies if the employer did not offer a Roth option for their 401k or qualified non-IRA retirement plan in the previous tax year (the first year of this test will be 2024).

For Business Owners

Small Business owners have more Roth plan options for themselves and employees: Starting 2023, employersmay now establish SIMPLE Roth IRAs and SEP Roth IRAs, allowing after-tax retirement funds to grow and be withdrawn without further income tax if certain conditions are met.

Business owners and employers may now make Roth contributions to employee retirement plans: Effective immediately, business owners and employers may also now deposit after-tax, Roth contributions (e.g. matching or non-elective Roth contributions) to employees’ Roth 401k and 403b accounts. These amounts are taxable to the employee and employer as income but are immediately vested and will not be taxed upon withdrawal (following similar rules to other Roth accounts). Previously, employers were only allowed to contribute pre-tax dollars into retirement plans.

For All

Retirement account early-withdrawal penalty waived for $1,000 emergencies: Effective 2024, employees may withdraw up to $1,000 from their retirement account once per year for “unforeseeable or immediate financial needs relating to necessary personal or family emergency expenses” without having to pay the 10% early-withdrawal tax penalty. No additional emergency withdrawals may be made without penalty during the next three years unless the original emergency withdrawal amount has been repaid to the retirement account.

Retirement savings “Lost and Found” database: By 2024, the creation of a new database will begin helping workers and retirees find retirement funds they misplaced from past employers.

New 529-to-Roth IRA transfer ability, with limits: Beginning in 2024, a beneficiary of a 529 plan may transfer a limited amount of unused 529 college savings funds into a Roth IRA without tax or penalty if several conditions are met.

- A 529 plan that’s been opened for 15 years or longer may have the funds moved into a Roth IRA in the same name as the 529 plan beneficiary.

- That individual may not transfer 529 plan contributions (or the resulting earnings) that occurred within the last five years of the 529 to Roth IRA transfer.

- The individual may transfer up to the Roth IRA contribution limit per year (minus any funds the individual has already contributed to IRA and Roth IRAs for the tax year) for several years, up to a lifetime maximum of $35,000 per individual. In other words, the beneficiary may “fill up or top off” their annual Roth IRA contribution limit using their existing 529 plan funds for several years if they meet the other conditions. Consult with a tax advisor or CPA for details.

The Takeaway

While most of the changes to be brought on by Secure Act 2.0 won’t be coming until 2024 and beyond, it’s wise to start talking with your financial advisor and tax preparer now about how you can best prepare for and take advantage of these coming changes. As a financial plan can show you, making larger retirement plan contributions today (or maxing them out if you can) could lead to financial independence months or even years sooner than you thought possible!

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.