by Christian Hudspeth, CFP®

When the stock market is down double digits, you may hear advisors saying it’s a great time to do a Roth IRA conversion. To be sure, the conversion strategy can save some people tens of thousands of dollars in taxes during their lifetime. But not always – we’ll get to that.

When you do a Roth IRA conversion, you’re drawing pre-tax dollars out of your traditional 401ks and IRAs, paying income tax on that money, and then putting those now-after-tax dollars into a Roth IRA where they can grow tax free for the rest of your life (Read: No RMDs).

The best part of a Roth IRA is, no matter how large your Roth IRA balance gets, your withdrawals from it are tax-free for the rest of your life as long as you follow a few simple rules.

And the reason why Roth IRA conversions are popular during bear markets or market corrections is because you can sometimes pay less overall in taxes in the long run after the conversion than you would if you kept that money in a traditional IRA or 401k.

Saving Thousands During a Down Market Using a Roth IRA Conversions

Here’s how a Roth IRA conversion can potentially save you a significant amount in federal income taxes during a down market, given the current tax law as of 2022 (no one knows for certain if future tax laws changes may alter one’s opportunity to perform this strategy, so check with your advisor).

Let’s say someone has $200,000 in a traditional IRA. Converting the entire balance into a Roth IRA in the 24% tax bracket could cost $48,000 in federal income taxes which would leave a Roth IRA balance of $152,000 after the conversion.

Now, let’s say that same person was to convert their account when it was down 20% and their $200,000 traditional IRA balance fell to $160,000. By performing a Roth IRA conversion during the down market, they’d only have to convert $160,000 from the traditional IRA into a Roth IRA, paying $38,400 in income taxes at a 24% tax rate ($160,000 x 24% = $38,400).

That’s a potential savings of nearly $10,000 in federal income taxes with a well-timed conversion in this example.

But a Roth IRA conversion may not be a good idea for everyone. In fact, performing a conversion the wrong way or at the wrong time may end up costing you thousands more in unnecessary taxes.

Avoid Overpaying on Taxes by Watching Your Tax Brackets

In the example above, we assumed the person converting to be fully in the 24% tax bracket even though they would be realizing $160,000 in additional income from an IRA distribution to do the Roth IRA conversion. We also assumed they expect to be in the 24% tax bracket (or lower) in their retirement years.

But not everyone is in this situation. In fact, sometimes large Roth IRA conversions can push someone into a higher tax bracket, causing them to pay thousands of dollars in unnecessary taxes.

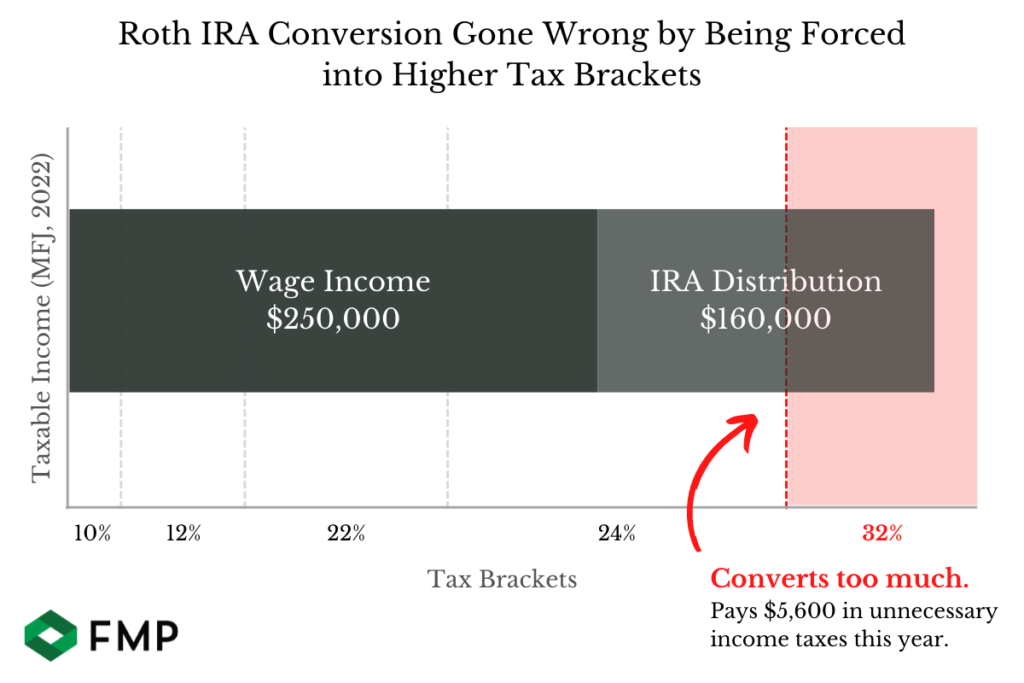

Let’s again use the example of a $160,000 Roth IRA conversion, but let’s also say this person and their spouse are at the height of their professional careers already earning $250,000 per year in taxable income (after tax deductions).

A $160,000 IRA distribution plus $250,000 in earnings after deductions would put their taxable income at $410,000, pushing them above the 24% bracket and into the 32% bracket. Because the 32% tax bracket begins at $340,100 (in 2022), that means almost $70,000 of the Roth IRA conversion would be subject to the higher, 32% tax bracket.

Paying 8% more (32% tax bracket versus the 24% tax bracket) for income taxes on $70,000 comes out to $5,600 in additional and unnecessary income taxes. I don’t know about you, but I know plenty of people that would rather spend that money on a vacation.

The only way a conversion in this example would be suitable is if their financial plan predicted they’d be in the 32% tax bracket during retirement, with income above $340,000 per year in inflation-adjusted dollars, in which case they might be paying that tax rate anyway as they took IRA distributions.

A Better Way: Partial Roth IRA Conversions

Before performing a Roth IRA conversion, it’s vital to pay attention to your taxable income levels during the year. The key is finding the balance where you’re paying a lower tax rate on your conversion dollars today than you expect to be paying on your income in retirement.

If you convert too much in one tax year, you may be forced into higher tax brackets that could cost you thousands of dollars in unnecessary income taxes.

On the other hand, if you don’t convert some of your IRA and other pre-tax dollars before you turn age 72, you may be forced to take oversized RMDs that could also push you into higher-than-necessary tax brackets during your retirement years.

One valuable service we provide to our clients each year is IRA Distribution Planning, a form of planning that could save money in total income taxes over a person’s lifetime.

Usually performed near the end of the year, we look at each client’s financial situation by:

- Analyzing every source of income a client made during the year

- Comparing the client’s current tax bracket with their future tax bracket according to their financial plan and/or other sources

- Recommending the optimal amount of Roth IRA conversion to avoid being pushed into higher tax brackets and paying thousands of dollars in unnecessary taxes and Medicare Part B & D surcharges

Our goal is to advise clients on a good amount to execute Roth IRA conversions at the right time — when their plan suggests the move can save them taxes over the long term.

Bottom line: Down markets can be the first ingredient toward an excellent tax-saving strategy that is the Roth IRA conversion, but your unique situation needs to fit if you want to avoid overpaying in taxes. By working with a trusted tax professional and/or financial planner, you can get the assurance you need if there’s an opportunity to save a substantial amount of tax dollars now and during your retirement years.

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.