by Christian Hudspeth, CFP®

The Social Security decision. Nearly every taxpayer in America must make it.

When should I take Social Security? Could I be penalized or miss out on thousands of dollars over my lifetime if I make a mistake? How do I know if I made the right decision?

The “when and how” of taking Social Security benefits is a crucial decision that will likely impact the next 20 or even 30 years of your life after you start taking benefits. And if that’s not stressful enough, this is one decision where you can’t change your mind later!

With stakes so high, it’s completely understandable why we get so many questions about Social Security.

Not to worry. Here we answer some of our clients’ most popular Social Security questions so you can be more prepared when it’s time to make your big decision.

I want to keep working and collect Social Security checks at the same time. Will my benefits be penalized?

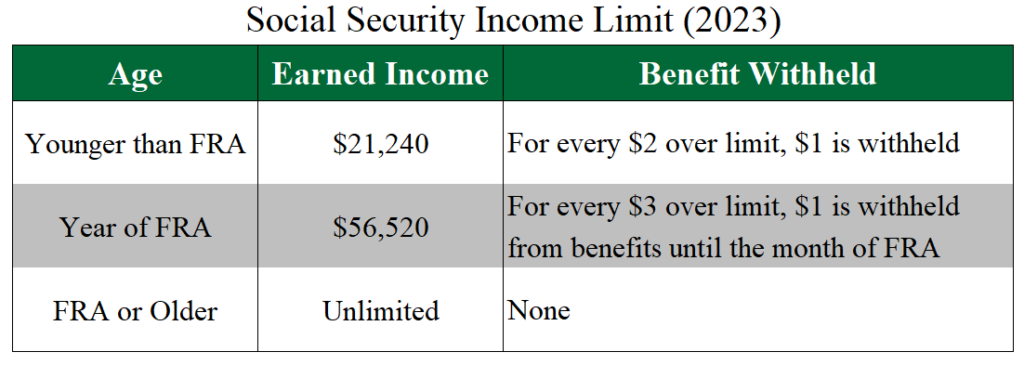

It depends! If you are older than your full retirement age (FRA), which is age 66 or 67 depending on your birth year, you can earn any income with no reduction in Social Security benefit. If you begin collecting earlier than your FRA and earn wages of more than $21,240 per year (in 2023), Social Security will withhold $1 for every $2 of your benefit over this annual limit (see table below).

If I don’t take Social Security now, will I miss out on cost-of-living adjustments (COLAs) – or “raises” — in my Social Security checks?

This news comes as a pleasant surprise for many. If you are 62 or older, your projected Social Security benefit will rise with the COLA even if you’re not currently collecting Social Security. This means you won’t miss out on these benefit raises if you decide to delay getting Social Security benefits.

Will my Social Security benefits be taxed?

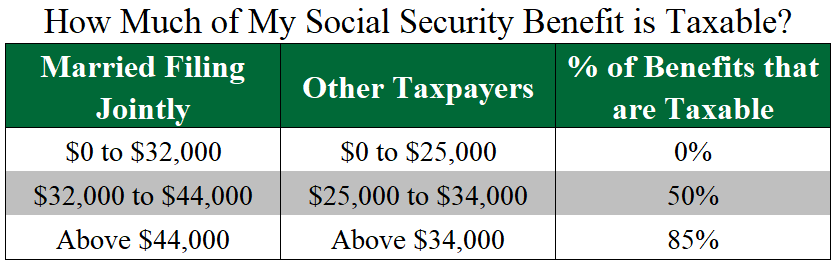

If you’re collecting Social Security benefits while receiving other income including wage income, traditional IRA/401k withdrawal income, rental income, capital gains, or dividend income, up to 85% of your Social Security benefit could be taxable.

To see if, and how much, you’ll be taxed on your Social Security benefit, take half of your annual Social Security benefit and add it to the total of your other income (including tax-exempt interest). Use this figure with the table below to see what percentage of your total benefit will be taxable.

Will Social Security be there to keep paying benefits when I retire?

A lot of people we meet have a “take the money and run!” attitude with this question. While no one can guarantee Social Security will be around when you retire, experts mostly agree the program will continue in some form for decades into the future. Actuaries from the Social Security Board of Trustees project the program to fully fund Social Security benefits until year 2034. And, even after that time, continuing payroll tax revenue “will be sufficient to pay 77% of scheduled benefits,” or $770 for every $1,000 in benefits promised.

Will my Social Security benefit be reduced if I work a lower-paying job?

Many people understandably like to reduce their workload toward the later years of their career. So here’s what you need to know: the Social Security Administration bases your benefit on the average of your highest-paid 35 years of earned income (i.e. years when you paid into Social Security through payroll taxes).

For most nearing retirement, taking a lower-paying job is a non-issue. If you’ve averaged $100,000 per year in wages and salary over 35 years and make substantially less as a part-time consultant in the years following, your benefit will still be based on the $100,000 per year, 35-year average.

But for mid-career workers, taking a lower-paying job could reduce your projected benefit. For example, a 43-year-old executive who’s made an average annual income of $200,000 over the past 20 years would have a Social Security Statement that reads, “these personalized estimates are based on your earnings to date and assume you will continue to earn $200,000 per year until you start your benefits” (emphasis mine) under the Retirement Benefits section.

That means if this executive were to switch jobs and become a consultant making $50,000 per year, the remaining 15 years of their 35-year projected average would adjust, reducing their next Social Security benefit estimate.

The Biggest Social Security Question of All

By far the most common question we receive is, “when should I claim my Social Security benefit?” Ultimately, the answer is a combination of these questions and your unique situation. If you claim benefits while you’re working, you could face a 50% reduction in benefits. If you claim benefits while taking large IRA distributions, you could be paying more in income taxes than necessary. And what if the Social Security Administration were to reduce your benefit in the middle of retirement? Do you have a plan for that?

The Social Security decision is a crucial one that you only get one shot at. Work with a financial advisor that can give you the confidence and peace of mind that you’ve made the right choice in your decision as part of a sound financial plan. You’ll be glad you did!

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.