by Christian Hudspeth, CFP®

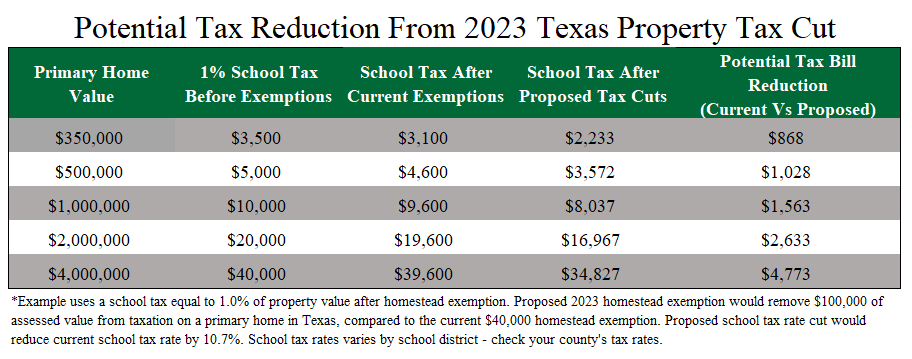

Property tax cuts may be on the way for Texans this year. Using some of the state’s $30-billion budget surplus, Texas legislators recently passed what they call “the largest property tax cut in the history of Texas,” which aims to reduce the average Texas homeowner’s annual property tax bill by roughly $1,300 according to lawmakers.

If Texas voters approve of the state constitutional amendment on November 7, 2023, the new legislation would reduce property taxes by:

- Raising the residence homestead exemption to $100,000 (from the current $40,000) on a primary home for Texas homeowners and to $110,000 for resident homeowners age 65 and older. The homestead exemption reduces the assessed amount taxed by a local school district, which in turn reduces a homeowner’s overall property tax bill.

- Lowering tax rates paid to school districts by 10.7 cents per $100 assessed (Note: The revenue to schools will come from state money instead of this property tax to not affect school budgets).

- Putting a temporary 20% cap on annual appraisal increases for landlords for investment or rental properties valued at $5 million or less.

The Proposed $100,000 Residence Homestead Exemption

If your Texas home is your principal residence as of January 1st of a tax year, you are considered a “homesteader” and may apply for the tax-saving residence homestead exemption, which effectively lowers your school district property taxes by reducing your home’s assessed value. A Texas homeowner usually applies for the homestead exemption in the first year they live in the property as their main residence.

The proposed new law would increase the homestead exemption to $100,000 ($110,000 for homeowners over age 65), up from $40,000 currently ($50,000 for homeowners over age 65), which would further reduce the taxable value of properties as it applies to school property taxes.

For example, if your home has an assessed value of $1,000,000 from your local appraisal district, the $100,000 homestead exemption under the proposed property tax law would have you pay school property taxes on $900,000. If your school district’s property tax rate is 1%, you’d pay $9,000 instead of the $9,600 you would pay under the current property tax law, reducing your tax bill by $600 per year.

The Proposed 10.7% Texas School District Tax Rate Cut

Beyond the increased homestead exemption, even more property tax reductions could come from the school district tax rate cut of 10.7 cents per $100 property assessment, which favors higher-value homes.

For example, after applying a $100,000 homestead exemption, this provision could reduce annual property taxes on a $500,000 home by $428. On a $1,000,000 home, the annual property tax would be reduced by $936 for a homeowner*.

Together, the $100,000 homestead exemption and the School District Tax Rate Cut could save the average Texas resident homeowner more than $868 per year in property taxes compared to current tax exemptions and rates, not accounting for changes in home assessment values.

Landlord Tax Relief: A Temporary 20% Cap on Annual Property Value Appraisals

While Texas homesteaders enjoy a 10% cap limit on home assessment value increases each year, landlords who own investment and rental properties in Texas haven’t had this tax break. In fact, some clients we’ve talked to in central Texas witnessed their investment property values – and property taxes – rise by 50% or more in 2022 alone.

The proposed law would enact a 20% annual cap on appraised value increases for individual business properties worth less than $5 million. For example, a $1,000,000 rental property that rises in market value by 30% for the year to $1.3 million would only be taxed on an assessment value of $1.2 million. With the cap in place, avoiding $100,000 of taxable value at a 2% property tax rate would yield property tax reductions of $2,000 in this example.

The temporary 20% annual cap would be in effect for each of the next three years, should the law pass in November. Eligibility for the cap would be based on the value of each parcel of property rather than an entire portfolio of properties owned by a single business according to the Texas Tribune.

As is the case with homesteaders, landlords with Texas properties would also benefit from the 10.7% reduction in school property tax rates, which could potentially reduce their tax bills by hundreds of dollars more.

How to Best Prepare for Future Property Tax Changes

The proposed property tax cuts would need to be approved by Texas voters on November 7, 2023 to become official law and have an effect on property tax bills. Some opponents of the yet-to-be-ratified tax changes may argue the state budget surplus could instead be used within the Texas education system. Others may raise questions about replacing part of a property tax-based revenue for school districts with revenue that’s dependent on the legislature to allocate money on a regular basis.

Whatever voters decide this fall, it’s never too early to prepare for property taxes and other expenses that could impact your future financial goals.

A trusted financial advisor with a proactive financial planning team can help you:

- Prepare for rising property taxes that grow with home appraisal values

- Use existing property tax breaks to help slow property tax growth in retirement

- See potential changes in your property tax should you relocate to a new home now or in retirement

- Maximize your federal income tax deductions for property taxes by looking at how you use your property — whether it’s a primary home, a second home, or an investment property.

Being prepared for property tax rules and changes can have a huge impact on how, where, and when you retire. And if you’re already retired, smart financial planning can bring confidence that you won’t outlive your money, with or without the help of future property tax relief.

Sources:

ABC13 Houston: Gov. Greg Abbott signs $18 billion package for homeowners and smaller businesses

Texas Tribune: Texas Property Tax Cuts Explained

*Methodology:

The school rate tax cut is 10.7 cents per $100 of assessed value, or a 10.7% reduction on the school tax rate. For a $1,000,000 home, this would apply after the $100,000 home exemption. Both the 10.7% school tax cut and the $100,000 homestead exemption depend on the passage of the law in November.

$1,000,000 – $100,000 home exemption = $900,000 assessed value

$900,000*(.107/100)) = $963 reduction in property tax bill

*The information presented here is not specific to any individual’s personal circumstances. FMP Wealth Advisers is not providing investment, tax, legal, or retirement advice or recommendations in this article.

**To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

***These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.